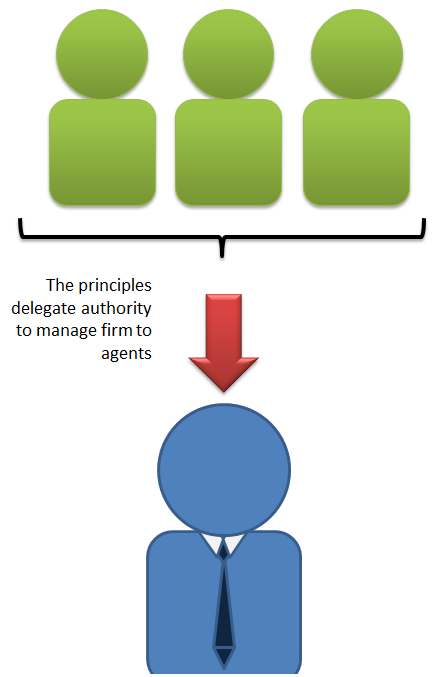

Accounting finance economics law political science strategy or organizational psychology. In this relationship the principal hires an agent to do the work or to perform a task the principal is unable or unwilling to do.

Pdf Agency Theory Approach Of The Relationship Between Performance Compensation And Value Creation In The Companies Listed On Euronext Lisbon

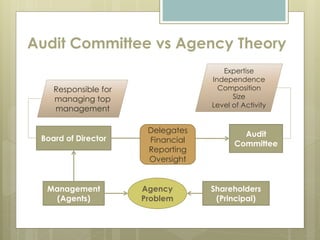

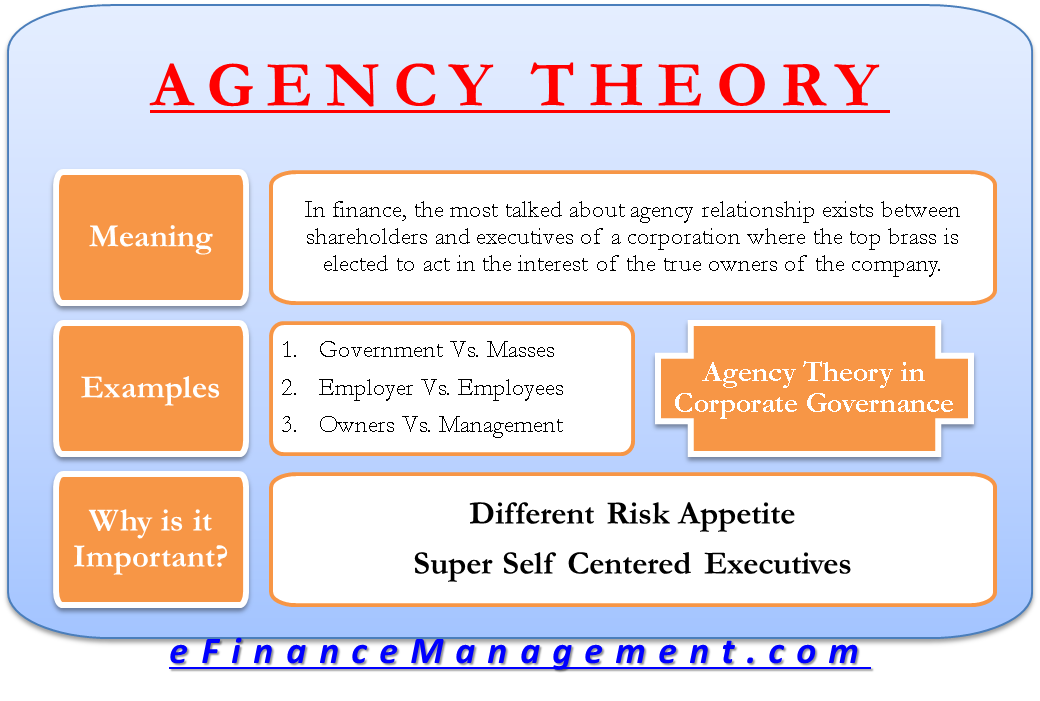

Agency theory looks at the relationship between the owner of the rm ie the principle and the managers of the rm ie the agents.

. Companies that are quoted on a stock market such as the London Stock Exchange are often extremely complex and require a substantial investment in equity to fund them ie. This essay shall use the tools of agency theory to analyse remuneration in the financial sector. Agency theory describes managers as agents and shareholders as principals.

Agency Theory and Executive Pay The Remuneration Committees Dilemma Authors. Reinforcement and Expectancy Theory Equity Theory and Agency theory which are explained below. Alexander Pepper Provides up to date examples and case studies to help illustrate the arguments Describes the standard model of the firm before providing a critique of.

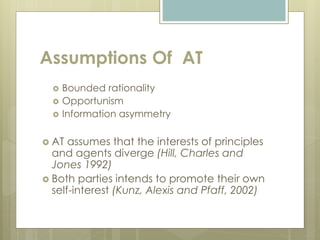

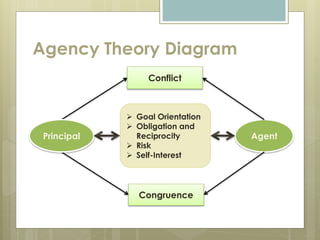

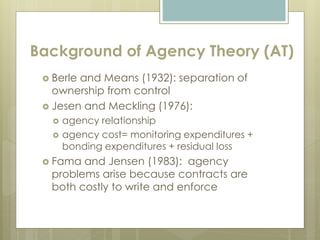

The agency theory examines the duties and conflicts that occur between parties who have an agency relationship. In this theory one party the principal hires another the agent who possesses specialized skills and knowledge. It argues that while Jensen Meckling 1976 were right in their analysis of.

Agency Theory Agency Theory explains how to best organize relationships in which one party determines the work while another party does the work. The first was the Act Regarding the Disclosure of Management Boards Remuneration. The principal-agent model explains the reason for such compensation instead of a flat salary.

Reinforcement and Expectancy Theory. Employers and employees are the two stakeholders of a business unit the former assuming the role of principals and the latter the role of agents. Most remuneration frameworks in the literature have been largely influenced by agency theory.

This theory which explains the relations between owners and managers needs to be revisited in the light of current debates on the performance of companies and the remuneration of. There are various theories in understanding remuneration out of which three different theories will be discussed as follows. An employee would do the same.

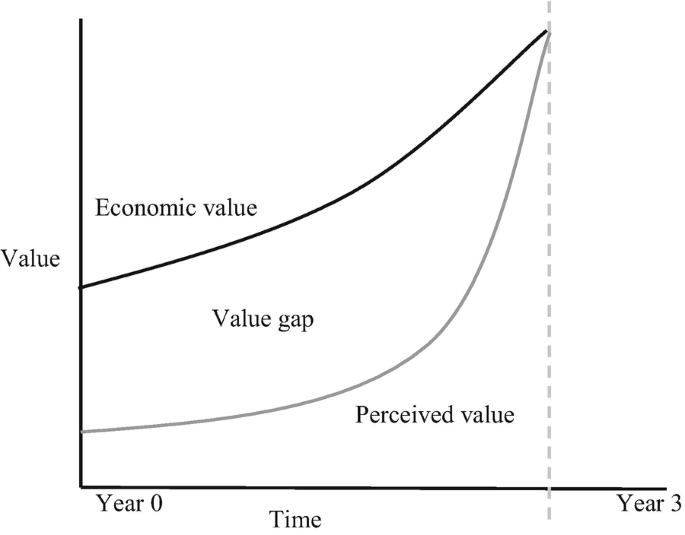

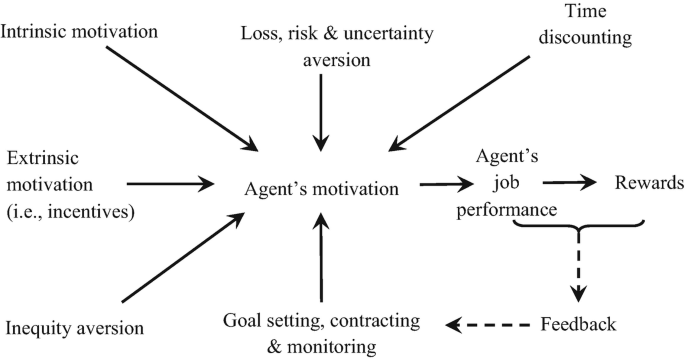

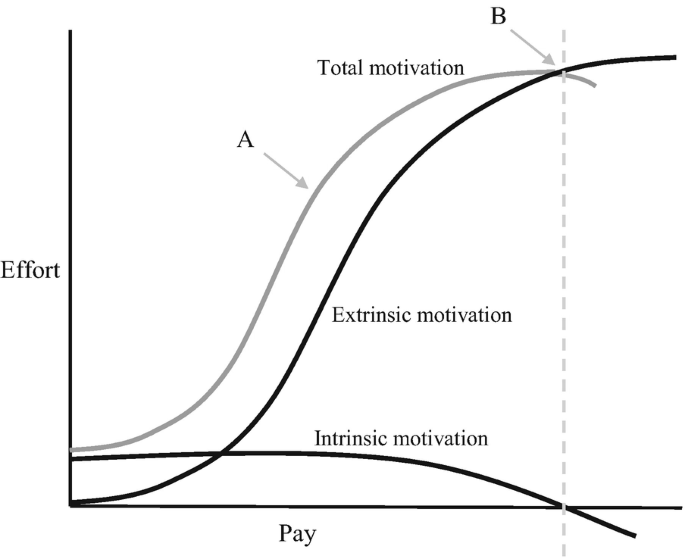

The psychological contract theory. There is a need to extend agency theory with some complementary theories to make executive compensation more realistic. Nevertheless against all expectations management salaries have been leveled and unfortu- nately even boosted.

Yet hundreds of papers in economics finance accounting and management have reached no consensus on whether executive compensation is efficient or whether empirically it conforms to the prediction of the principal-agent theory. The agency theory seems to justify high remuneration because of a performance contract where the managerial power theory argues for a dysfunctional system where executives reward themselves more than is necessary. However consistent proof of both theories is still lacking.

This theory is based on the assumption that the reward -earning behavior is likely to be repeated ie. However notable divergences exist between thepredictions of agency theory and reality. The agency theory has interested several disciplines.

There are three theories of compensation viz. They often have large numbers of shareholders. The theory argues that the value of a firm cannot be maximized if appropriate incentives or adequate monitoring are not effective enough to restrain firm managers from using their own discretion to.

Its main purpose is to provide companies an incentive toward establishing appropriate perfor- mance-based management compensation. Agency theory can be applied to the agency relationship deriving from the separation between ownership and control. Agency theory is used to understand the relationships between agents and principals.

The book examines the relationship between agency theory and executive pay. Agency theory is often described in terms of the relationships between the various interested parties in the firm. Agency Theory The agency theory focuses on the divergent interests and goals of the organization s stakeholders and the way that employee remuneration can be used to align these interests and goals.

The agency theory focuses on the divergent interests and goals of the organisations stakeholders and the way that employee remuneration can be used to align these interests and goals. The agent represents the principal in a particular business transaction and is expected to represent the best. Employers and employees are the two stakeholders of a business unit the former assuming the role of principals and the latter the role of agents.

Panda and Leepsa 2017. Specifically it will attempt to ascertain whether remuneration policy can lead to excessive risk taking and if this is the case whether it should be controlled by regulation. A problem usually arises when the employees receive fixed pay and know that regardless of performance their remuneration is guaranteed thereby luring the employees to moral hazard.

Agency relationships occur when one party the principal employs another party called the agent to perform a task on. Agency theory speaks to how the employer will remunerate employees to ensure their priorities and goals are aligned with their own.

Pdf How Well Does Agency Theory Explain Executive Compensation Published In Federal Reserve Bank Of St Louis Review

An Introduction To Monetary Theory Grin

Agency Theory In Corporate Governance Meaning Example Importance

Behavioural Agency Theory Springerlink

Agency Theory In Financial Management Mba Knowledge Base

Behavioural Agency Theory Springerlink